The Untouchable Saudi Grade

Read in 3 minutes

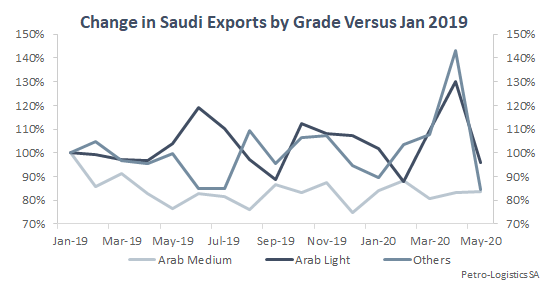

When Saudi Arabia decides to increase or decrease production as part of its OPEC strategy, the market is generally aware that Arab Light as the highest volume grade and Arab Heavy as the lowest value grade are key swing barrels. What goes less noticed though is that in the midst of the wild production swings, loadings of one key grade barely budge: Arab Medium.

Structurally, Arab Medium is the second largest export stream after Arab Light. 2019 Arab Medium loadings were 11% more than Arab Heavy and 34% more than Arab Extra Light.

Arab Medium’s stability has been particularly visible in the whipsaw of the past few months. April’s massive total production increase saw Arab Light move up strongly with the limited spare production capacity of Arab Extra Light and Arab Heavy contributing a little bit more. Arab Medium barely budged though. The May cuts gave an even starker illustration as loadings of Arab Heavy dropped -37% month-on-month, Arab Extra Light -33%, and Arab Light -26%. But Arab Medium, was virtually dead flat.

Why is Arab Medium so steady? One clue is in the more concentrated customer base. Arab Light’s top three customers take just 22% of its volumes. Arab Heavy’s take 31%. Arab Extra Light’s 36%. But Arab Medium’s take 46%. So few customers likely means tighter relationships designed to supply consistent baseload supply which no one wants to see disrupted.

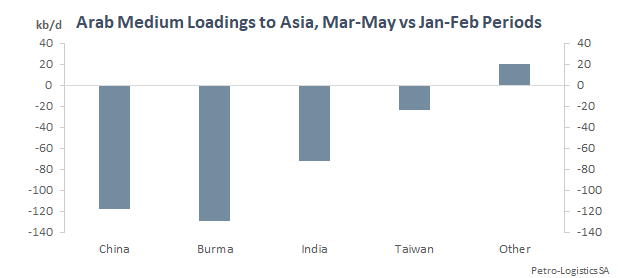

Another clue in the data comes from what happens when Arab Medium’s Asian baseload customers (who account for 87% of loadings) aren’t taking barrels. Such as for refinery maintenance or now the Covid demand crisis. As the Covid demand collapse began, loadings of the grade to Asia in the March to May period fell -25% versus January and February.

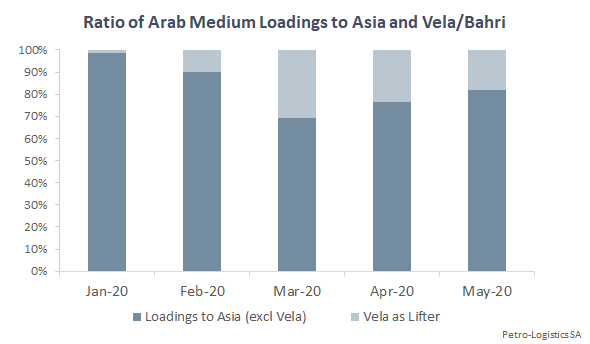

And yet total global Arab Medium loadings stayed flat all the way through the production surge in April and drastic cuts in May. Even as every other grade was cut in May and demand sat in the doldrums, Vela took the Arab Medium barrels Asian customers wouldn’t and moved them to the US. While everything else was being slashed amidst the most chaotic oil market in generations, a deliberate decision was made by the Saudis to use their own system assets to keep Arab Medium loadings (and presumably production) steady. That is a sign of strong commitment to the grade.

BLOG UPDATE JULY 2024: Since posting this article four years ago, the basic points that Arab Medium production is very steady compared to other grades and that it has a relatively concentrated customer base have continued to be true. Indeed, the customer base has become even more concentrated with the top 3 customers comprising 61% of all loadings in Q2 2024.

However, there have been some notable changes in the customer base, primarily as a result of the startup of the Jizan refinery which has become the single largest discharge location of the grade. Because such internal transfers are not included in our export metric, the apparent decline in Arab Medium exports masks the fact that total loadings have in fact remained structurally steady.