Temporary UAE Export Jump Points to Bigger Changes

Read in 2 minutes

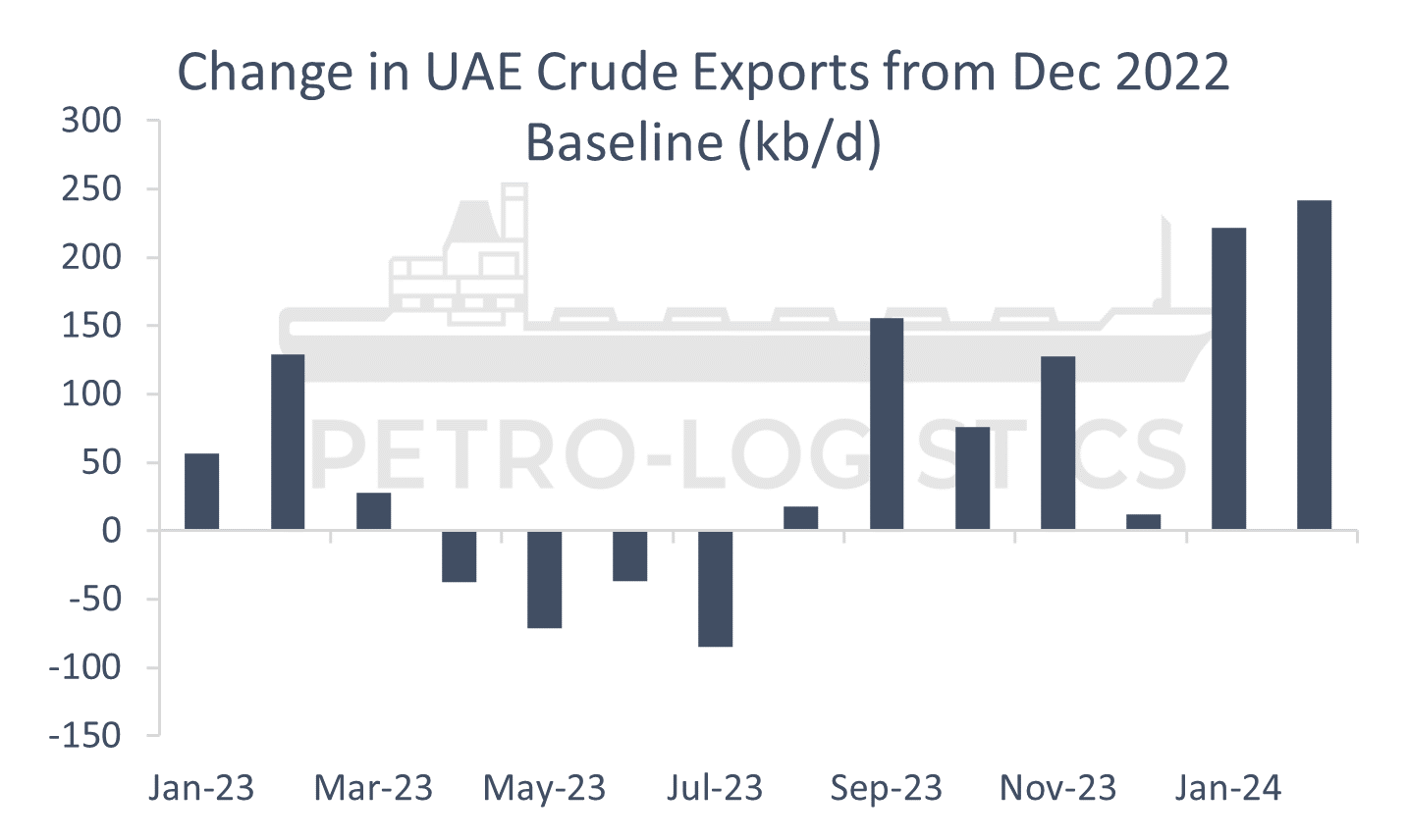

January and February have seen a large jump in UAE crude exports, increasing 5% versus 4Q23 to the highest level since July 2022. The main factor has been the partial Ruwais refinery maintenance in 1Q24. This has caused exports of the higher quality crude the plant normally runs to shoot up.

January and February have also seen the highest UAE internal crude transfers on record. All of it has been offshore crude being brought into Ruwais, with inflows actually beginning at lower levels in 3Q of last year. Simultaneously, record volumes of the higher quality crude run by Ruwais have been sent by pipeline to Fujairah and exported at levels 42% higher in January and February compared to 4Q23.

The reason for these shifts goes beyond the current temporary refinery maintenance. ADNOC has completed the $3.5 billion Ruwais Crude Flexibility Project. When maintenance ends, this will allow it to run significant volumes of heavier and more sulphurous domestic offshore crude, freeing up higher-value crude for export.

The offshore grade that Ruwais is expected to run more of is around 6 degrees API heavier with 1% more sulphur. It also produces substantially less kerosene and more residual fuel oil off the crude distillation tower. Assuming the plan is to run more resid through secondary processing units, the project would appear to be aimed at increasing the amount of non-kerosene middle distillate output.

The export slate will shift with more light sour and less medium sour as a result of these upgrades. The precise long-term volumes of increased medium sour that will be run at Ruwais remain to be seen given that the volumes from September to February have likely been for tankfill in preparation for the shift.

The name of the “flexibility” project indicates that economics will drive fluctuations in the crude slate over time, including the possibility of crude imports from other countries. Given that the new domestic medium sour to be run is an offshore grade, Petro-Logistics is and will continue to track how much is brought directly into Ruwais. The neighboring Jebel Dhanna Terminal is also being expanded to allow more of the grade to be brought into the refinery. Subscribers to Petro-Logistics tanker-level data will be able to track these movements including the specific grades and volumes on a daily basis.

[To read this post with more numbers and detail, clients can click here for the full note and potential clients may contact us here for a free two-month trial with no obligations.]