Black Sea on Edge: Disruption Risk Reaches Novorossiysk

Read in 3 minutes

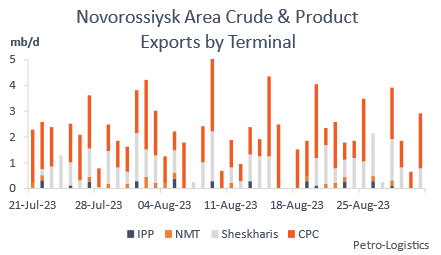

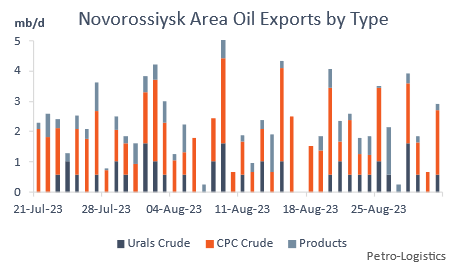

Two recent incidents at Russia’s Black Sea port of Novorossiysk have highlighted that the conflict in Ukraine has elevated the risk of disruptions to Russian and FSU oil exports. For 2023 year-to-date, Novorossiysk (counting the segments fed by both Transneft and CPC pipelines) is the source of 2.0 mb/d FSU crude oil, and another 331 kb/d of products.

The first incident on 4 August involved a Ukrainian explosive sea drone damaging the Russian navy vessel Olenegorsky Gornyak near the port. Such attacks have become more frequent further west in the Black Sea, but this was the first time a port city that serves as a major oil export hub had seen such an attack. Then on 18 August, a major fire broke out at the cargo terminal in Novorossiysk, with residents reporting explosions.

These events provide an initial insight into what impacts can be expected from the elevated risk. Insurance rates are reportedly up, but operationally very little changed. On 4 August, the Sheskharis and CPC terminals at Novorossiysk were briefly closed, but both re-opened quickly the same day and pumping through onshore infrastructure was not said to be impacted at all. No new tankers arrived to load crude oil at either terminal until 7 August, though tankers that were already at berth were able to leave over the weekend. The volume of loadings from the area’s terminals continued at a fairly normal pace in the surrounding days (a lack of crude loadings on August 7 was coincidental and not related to the attack).

On 18 August, the impact of the port fire was obscured by the fact that there had been bad weather hampering arrivals and loadings at the time. No tankers loading crude oil at the Sheskharis terminal arrived between 16-20 August, with no crude or products loading from any of the local terminals at all on the 17th, and no non-CPC crude from the 16th to the 19th. As a result, there was a temporary but substantial 60% week-on-week reduction in crude oil exports from Novorossiysk. Nonetheless, total volumes in the days following the fire show no notable deviation from patterns that would normally be seen anyways in the event of a weather disruption, showing the limited impact of the explosions.

The data thus suggests that at the current scale of attacks, Russian authorities remain comfortable continuing fairly normal operations with only brief pauses to assess the situation. Despite higher insurance rates, the current pool of lifters remains comfortable continuing their purchases.

Can this relative calm continue? If attacks increase – and Ukrainian capabilities to reach Novorossiysk and other terminals do appear to be growing – it is of course impossible to predict precise impacts. But the limitations on damage that can be caused at such a distance from Ukraine, and the ability of Russia to martial large logistical resources on its home territory, suggest that major port disruptions are unlikely.

In addition, there is a logical threat balance between the two sides. Ukraine wants to be able to move grain from its ports in the western Black Sea, and Russia oil from the eastern Black Sea. Limited attacks allow each side to show they can threaten the other, and paradoxically may provide an incentive to limit the damage they seek to inflict on the other’s ports.

On net, while war is always rife with unknown unknowns and a large tail risk impacting FSU oil exports from the Black Sea can never be ruled out, the events of August suggest that thus far the fighting is not at a stage likely to lead to a major disruption to flows.