The Effect of Reimposition of US Sanctions on Iran

Read in 10 minutes

This post is a shortened version of a Client Note released to subscribers of our Iran - Crude Oil Exports & Production Analysis package. The full note includes additional tables, graphs and commentary examining various others aspects of Middle Eastern tradeflows. Please contact sales@petro-logistics.com for samples or a complimentary trial.

Introduction

The US and the European Union imposed sanctions on Iran in 2012 relating to Iran’s nuclear programme that, among many impacts, severely restricted the ability of Iran to export crude oil. Further restrictions were imposed in subsequent years. However, many elements of these US and EU sanctions were lifted from the start of 2016, leading to a resurgence in Iranian crude exports. On 8th May 2018, President Trump signed an executive order that will re-impose over the succeeding 180 days, all of the sanctions on Iran that the US Administration had previously lifted in 2016. The US re-imposition of sanctions is due to the US Administration’s view that Iran is no longer fulfilling its obligations to restrict its nuclear programme. The European Union is highly unlikely to re-impose its sanctions, irrespective of the US decision, although exports of Iranian crude to Europe could subsequently be affected by any extra-territoriality nature of the US legislation. This note examines the impact of previous US and EU sanctions on Iranian crude exports and analyses the potential impact of the re-imposition of sanctions by US authorities.

US Sanctions

While a number of US sanctions on Iranian activities existed prior to 2012, it was the introduction of the National Defense Authorization Act (NDAA) for Fiscal Year 2012 that combined with other legislation enacted that year to represent a marked escalation the US sanctions policy. While Iranian exports of crude oil to the US had ceased many years prior to 2012, the US sanctions enacted in 2012 forced foreign banks and other institutions to terminate financial transactions with Iran in order to avoid being precluded from dealings on US financial markets. Purchases of Iranian crude consequently became problematic for many companies and countries. These measures targeted both private and government-controlled banks, including central banks.

The law, however, enabled a great degree of latitude over how the US Administration could implement the legislation, including allowing waivers for countries that were demonstrating that they were taking measures to significantly reduce their imports of Iranian crude. Waivers were justified if in the US national security interest or otherwise necessary for energy market stability. Subsequent legislation tightened the opportunity for Iran to repatriate earnings from oil exports and limited the use of such proceeds for non-sanctioned bilateral trade. Lastly, shipments of Iranian crude were affected by restrictions on the provision of Protection & Indemnity Insurance following further legislation that imposed sanctions on any insurance company that provided services for sanctioned activities.

EU Sanctions

The European Union had imposed certain sanctions against Iran and other countries in legislation passed in 2010. However, it was Council Regulation (EU No 267/2012) that escalated the level of sanctions to include, among constraints on other economic sectors, limits on Iranian crude imports. The legislation was far less extraterritorial than that passed by the US authorities but the impact on Iran crude exports was more marked, largely as the EU was a significant importer of Iranian crude volumes. EU sanctions imposed in 2012 also included financial, banking, insurance and shipping constraints that affected Iranian crude movements more generally. A subsequent tightening of legislation included a blanket ban on financial transactions between European and Iranian banks (unless approved for humanitarian reasons). It should be noted that as crude oil transactions are primarily priced in US dollars, clearing of such transactions were to be more closely impacted by US, rather than EU, sanctions legislation.

Joint Comprehensive Plan of Action (JCPOA)

The removal of US and EU sanctions on Iran, together with an easing of existing UN-approved sanctions, was enacted at the start of 2016. This followed the voluntary agreement between parties to the Joint Comprehensive Plan of Action (JCPOA), which involved not only US and EU authorities, but also the governments of China, France, Germany, the United Kingdom, the Russian Federation and Iran. The purpose of JCPOA was to negotiate the liftings of all UN, US and EU sanctions relating to Iran’s nuclear programme once sufficient confidence in the exclusively peaceful nature of Iran’s programme had been gained by all parties to the agreement. The agreement called for the implementation of a staged removal of sanctions in line with certain milestones being achieved by Iran, with a mechanism for independent verification of Iran’s adherence to its commitments and a mechanism to resolve disputes.

The partial removal of sanctions relating to crude exports became effective mid-January 2016, and such exports have since picked up substantially. It should be noted that parties to the agreement do so on a voluntarily basis and may unilaterally remove themselves from the agreement or use the dispute resolution mechanism to re-impose sanctions if Iran is seen not to be adhering to its commitments.

President Trump’s recent executive order seeks to re-impose all of the sanctions on Iran that were relaxed in early 2016. This has set in train a 180-day process for the full re-imposition of US sanctions, with the order specifying that many of the sanctions should be in place in ninety days – by 9th August 2018. The US administration regards as credible evidence provided by Israel that Iran is secretly developing a nuclear bomb. While European authorities are more sceptical and the International Atomic Energy Agency observers currently see no evidence to back up the claims, oil market participants may need to consider the potential impact on the oil market of the reinstatement of US sanctions on Iran.

Impact of Past Sanctions on Iran

In order to anticipate the extent of the impact on oil markets of a re-imposition of US sanctions on Iran, it is helpful to analyse the impact of previous sanctions imposed in 2012. Given the expectation that the EU is unlikely to re-impose its sanctions, irrespective of the most latest decision made by the US administration, the impact of the re-imposition of US sanctions is likely to be less notable than past coordinated actions. However, with most crude transactions cleared in US Dollars, any restriction in trading in US currency will have global implications, including actions by European market participants.

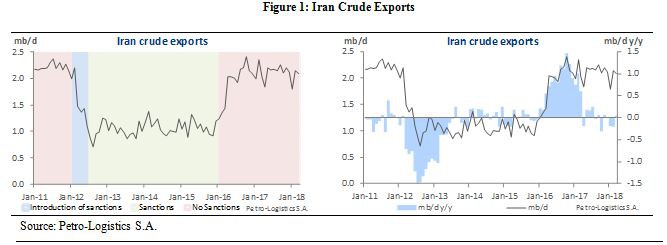

To aid our analysis of the impact of previous sanctions on Iranian crude exports, we have examined data in three distinct periods: pre-sanctions (Jan-11 to Dec-11), sanctions (Jul-12 to Dec-15) and post-sanctions (Jan-16 to Mar-18). For statistical comparison, we have excluded the period representing the first six months of 2012, when the introduction of US and EU sanctions were somewhat staggered and sanctions were not fully implemented until July of that year. These distinct periods are illustrated in Figure 1 below.

The imposition of sanctions had a profound and rapid impact on Iranian crude exports, with exports declining on an annual basis by almost 1.5 mb/d by mid-2012. From this point, the level of crude exports remained within a small range until the removal of sanctions in January 2016 whereupon exports rapidly returned to pre-sanction levels on a sustained basis. Iranian crude exports during the sanctions period were some 52% below pre-sanction levels.

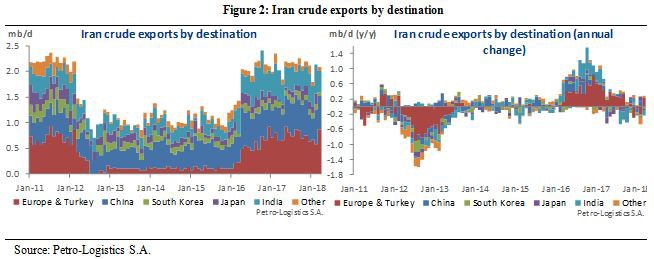

The impact of sanctions on the destinations of Iranian exports was also marked (Figure 2). Prior to the imposition of sanctions, China was the largest recipient of Iranian crude, importing more than 20% of all exported volumes. Europe and Turkey combined received almost one-third of Iranian crude exports. The remaining volumes were almost exclusively exported to other parts of Asia.

The imposition of sanctions was inevitably more pronounced for European & Turkish imports than for other countries and regions, with such volumes during the sanctions period declining by 86% as compared with pre-sanction levels. However, crude exports to Asia were also impacted, largely as US and EU sanctions incorporated a degree of extraterritoriality as financial transactions involving Iran that were transacted in US dollars or otherwise passed through European financial institutions were prohibited. Although the US authorities provided waivers to the prohibition of Iranian crude imports to Asian countries that were previously heavily dependent on Iranian exports, they were provided on the basis that attempts to minimise such imports were attempted. Certain countries, such as China, were less inclined to be influenced by US persuasion. As such, while Iranian imports during the sanctions period declined in Japan, Korea and India by 54%, 49% and 37% respectively from pre-sanction levels, imports into China declined by only 8%.

Following the removal of sanctions, overall Iranian crude exports rapidly recovered to pre-sanction levels. However, this recovery was not evenly spread on a destination basis. As one would expect, the recovery in exports to Europe & Turkey was most marked, having been most affected by the sanctions. European imports during the sanctions period had ceased completely, while Turkish imports had fallen to 100 kb/d. European and Turkish imports have since recovered to near pre-sanctions levels above 600 kb/d.

In contrast, while Korean and Japan imports have improved since the end of sanctions, levels remain significantly below pre-sanction levels. This may be due to a degree of crude substitution in the two countries’ refining sector in the aftermath of the dislocation arising during the sanctions period. More importantly, continuing uncertainty around transacting financially with Iran may have discouraged these two US allies from fully re-engaging with Iran. Indeed, two countries less tied to the US, namely China and India, have rapidly increased Iranian crude imports to significantly above pre-sanction levels. To an extent, this reflects rapid growth in refinery demand in these countries, but it also may represent an opportunity to increase purchases of continuingly-displaced and competitively-priced crude. Pre-sanctions, China and India were the recipient of 37% of all Iranian crude exports, but since the end of sanctions, these two countries’ market share of Iranian crude exports has risen to 52%.

The mix in the type of crude exported by Iran has changed over the last seven years. Details surrounding changes in Iran’s export grades in response to the imposition and removal of sanctions in recent years are contained in our Iran Report. Please contact us to arrange a trial subscription to this report.

Impact of Re-imposition of US sanctions on Iran

The US withdrawal from the Joint Comprehensive Plan of Action (JCPOA) voluntary agreement on 8th May, and the upcoming re-imposition of US sanctions that were in place before 2016, will disrupt the ability of Iran to export crude. But, in the highly likely absence of the EU also re-imposing its sanctions, the overall impact on Iranian exports will be far more muted than in the past.

Firstly, EU sanctions alone were almost exclusively responsible for more than half of Iranian exports lost in the previous sanctions period. Thus, the displacement of some 600 kb/d of Iranian crude exports to Europe that occurred due to previous EU sanctions is unlikely to be repeated.

Secondly, South Korea and Japan have not materially increased its Iranian crude exports following the end of sanctions, due to crude substitution at refineries and refinery closures, thus limiting the scope for further reductions. The 250 kb/d of Iranian crude displaced from Korea and Japan last time round is unlikely to be replicated.

Thirdly, China remains less inclined to respond to US persuasion and has become the destination of almost one-third of all Iranian crude exports. China is now importing some 140 kb/d more than pre-sanction levels.

A remaining area of uncertainty is the extent to which US sanctions legislation relating to the prohibition of undertaking financial transactions in US Dollars with Iran will affect behaviour of non-US market participants, particularly those operating in Europe. During the previous sanctions period, the US Government had provided waivers to a number of European countries (Belgium, the Czech Republic, France, Germany, Greece, Italy, the Netherlands, Poland, Spain, the UK, and Turkey). Only if the basis of the US waiver process is radically altered will new US sanctions severely impact European imports of Iranian crude, in the absence of the re-imposition of EU sanctions.