OPEC & Partners: Playing with Fire

Read in 7 minutes

The 178th OPEC meeting in March had dramatic consequences for the oil market, only partially corrected by the 9th joint OPEC-partners meeting in early April. Petro-Logistics extensively covers OPEC countries, their partners and the US Gulf of Mexico and provides clients with detailed insight on changes to oil supply and flows at a crucial time for the market.

A look back at OPEC since the beginning

First, let’s look back at how the crisis unfolded. OPEC (the Organization of Petroleum Exporting Countries) currently consists of thirteen of the world’s major oil-exporting countries. Besides the 5 founding countries (Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela) there are 8 additional members (with the year they joined): Libya (1962), UAE (1967), Algeria (1969), Nigeria (1971), Gabon (1975), Angola (2007), Equatorial Guinea (2017) and Congo (2018). Indonesia (1962) suspended its membership on the 30th on November 2016, Qatar (1961) left at the start of 2019 and Ecuador, who joined in 1973, elected to leave the Organization on 1 January 2020, having already suspended its participation between 1992 and 2007.

The Organization aims to coordinate petroleum prices to maximize the revenue from their respective production. To regulate market supply, the Organization often agrees oil production caps, which have a key impact on oil market and oil prices. Compliance levels are closely watched by oil traders and energy analysts.

The first time OPEC was able to show its power was during the 1973 Arab oil embargo when Middle Eastern oil producers retaliated against the United States for its support of Israel during the Yom Kippur War by stopping exports to the US. The move was not strictly an OPEC policy, but it did involve the most prominent members of the cartel. The embargo caused a sudden spike in oil prices around the world and a global energy crisis. It also demonstrated OPEC’s and the Middle East’s vital importance for world energy supply.

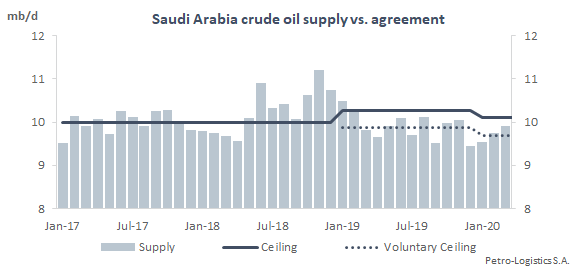

The production cap policy has regularly been used by OPEC to control oil prices. Saudi Arabia is usually the key mover within OPEC, joined by a couple of close partners, Kuwait and the UAE, as they have more room to maneuver, whilst others within the Organization have more stretched resources or less political will to participate in curtailment policies.

Trying a new strategy: The rise of the US shale oil exports

When in late 2015 US shale oil production started to be exported out of the Gulf of Mexico and compete with OPEC barrels, the Organization decided to try a different strategy to deter American producers. By maximizing production, OPEC hoped to lower prices so much that it would become uneconomic for high-cost US producers to continue their operations.

The oil price plunged from $110 per barrel in 2014 to less than $35 per barrel in 2016. This not only hurt some of the smaller US producers but also pushed OPEC economies into recession and eventually forced the Organization to rethink its policies. As a result, in December 2016, the OPEC member countries struck an agreement to place caps on their oil production.

New partners: Alliance with the non-OPEC-10

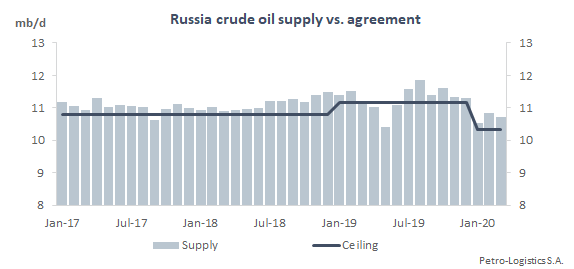

The 2016 agreement was also special because it included some non-OPEC producers. Russia, Kazakhstan, Azerbaijan, Mexico and a few smaller producers (Bahrain, Sudan & South Sudan, Oman, Malaysia and Brunei) agreed to join in the supply cap effort. The deliberate removal of about 1.8 mb/d from global supply only partially succeeded as prices improved but remained at low levels until late 2019, failing to sustainably recover over $75/bbl.

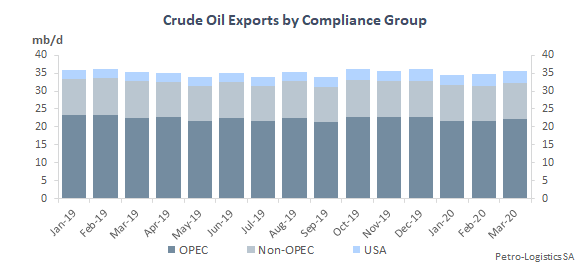

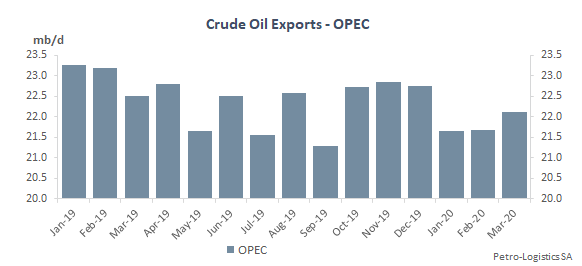

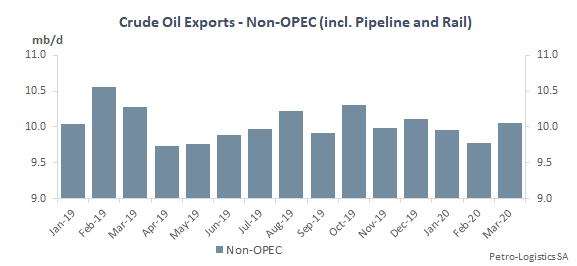

On average though, compliance with the curtailment agreement was poor amongst OPEC and OPEC+ partners except for Saudi Arabia (200% for 2019), Kuwait (201% in 2019) and others which tend to suffer from aging fields such as in Angola (184% for 2019) and Algeria (127% for 2019). In the first three months of 2020, according to Petro-Logistics’ own assessment, OPEC’s combined oil supply stood at 28.436 mb/d on average, with total exports reaching 21.815 mb/d, whilst the 10 partners’ total oil production was 17.288 mb/d with exports at 9.929 mb/d.

2020: Covid-19 and Saudi Arabia’s painful bet

The Covid-19 epidemic then hit, first impacting the world’s key oil buyer, China. OPEC and its partners were not sure how to react to the crisis. At the 178th Extraordinary OPEC meeting in early March, Saudi Arabia pushed for further cuts as it feared demand would be severely hit but Russia refused. Tired of carrying much of the burden as the most compliant country in the Organization, Saudi Arabia decided to increase its supply from about 10 mb/d to 12.3 mb/d from April 2020 onwards.

By mid-March, oil prices had experienced their biggest tumble in market history as traders prepared for a massive supply increase in late March. Indeed, other producers had decided to follow in Saudi Arabia’s footsteps and increase their production. At the same time, more signs appeared that demand destruction was deepening with more countries affected by the pandemic and adopting confinement measures.

By late March, Petro-Logistics reported higher export volumes out of Saudi Arabia, Kuwait and the UAE. In early April, many OPEC countries had ramped up supply with Saudi Arabia surpassing the 12.3 mb/d it had announced. Saudi exports jumped, reaching 10.000 mb/d for the first two weeks of April. Similarly, compared to the second half of March, Kuwaiti exports were up as were those out of Nigeria and the UAE.

For the FSU, compared to the second half of March, seaborne exports rose by 1.021 mb/d for the first two weeks of April.

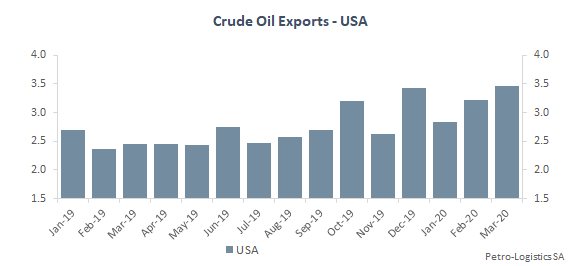

US exports out of the US Gulf of Mexico rose by 74 kb/d for the first two weeks of April versus the second half March, despite some rigs being shut down, as lower domestic refinery intake pushed more barrels to the international market.

From cartel to partner: The United States’ complex relationship with OPEC

Often perceived as a cartel, OPEC has regularly been the target of anti-OPEC legislation by the U.S. Congress, with the latest No Oil Producing and Exporting Cartels (NOPEC) bill introduced in the House of Representatives in February 2019. However, oil prices collapsed in March 2020 and rising oversupply quickly began hurting producers everywhere, including shale producers in the USA. The US administration decided to adopt a dramatically different strategy and called on OPEC and its partners to cut production to avoid oversupply and stabilize prices.

On 10 April, following negotiations between OPEC and non-OPEC partners as well as the US administration, and with several other producers observing (Argentina, Colombia, Ecuador, Egypt, Indonesia, Norway and Trinidad and Tobago), the group came to an agreement: a major 9.7 mb/d supply curtailment effective on the 1st of May 2020 until 30 June 2020, followed by 7.7 mb/d from 1 July to 31 December 2020, then 5.8 mb/d from 1 January 2021 to 30 April 2022, with a review in December 2021. The baseline for most countries remains their production levels in October 2018 except for Russia and Saudi Arabia, which will start from a supply level of 11 mb/d each.

Will curtailment be enough to curb the 2020 unique crisis?

Will it be enough to push oil prices up? First, the Organization’s and its partners’ track record on abiding by curtailment agreements remains poor, leading the market to adopt a wait and see attitude towards the promise of a major cut. Secondly, the crisis has now become a demand rather than a supply one, with lockdown measures destroying oil demand at historically unprecedented levels. As countries emerge from confinement measures, the speed of economic recovery will determine how much oil is needed and therefore how fast the oversupply is reduced. Currently, a 9.7 mb/d cut in supply from OPEC and its partners on top of well completions collapsing in the US and elsewhere do not seem to be enough to compensate for the anticipated oil market shrinkage.

Throughout its history, OPEC has periodically been claimed dead by market watchers. In recent years, as OPEC was forced to apply continually deeper cuts to balance the market, the chorus returned about the ineffectiveness of OPEC. The success of its policies can be argued, but as long as OPEC maintains spare capacity or is willing to create spare capacity by restraining production, its ability to turn the market on its head remains ever-present.

In the coming weeks, Petro-Logistics will continue to monitor and inform its clients as changes in supply and flows from OPEC, OPEC+ and the USGC occur.