OPEC+ closer to full compliance in June

Read in 3 minutes

Following the adoption of an agreement between OPEC and their 10 non-OPEC partners, the participating countries had set a production cutting target of 9.7 mb/d for May and June 2020 versus October 2018 levels of around 43.9 mb/d.

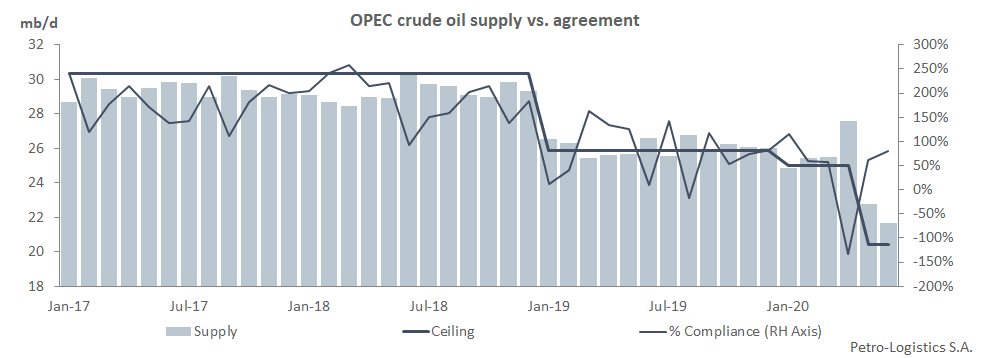

According to Petro-Logistics’ data and its own assessment of compliance, the group came short on its promise, with a total compliance level of 78% for June (versus 62% in May), bringing the group’s average compliance for May-June at 70%.

In early June, OPEC+ extended the May-June level of cuts to July and added a clause stating that members “subscribed to the concept of compensation by those countries who were unable to reach full conformity (100 per cent) in May and June, with a willingness to accommodate it in July, August and September, in addition to their already agreed production adjustment for such months.” In other words, any country that did not achieve 100% compliance in May-June should try to reach that level between July and September or face consequences.

Almost all countries party to the agreement continued to cut in June, albeit at a slower pace than between April and May, April having seen record output for some countries. Total supply in June dropped by 1.49 mb/d versus May levels for all participating countries.

The 10 OPEC members that are part of the agreement (OPEC-13 excluding Iran, Venezuela and Libya) had a total compliance level of 87% (versus about 62% in May) and at 74% for the May-June period. The best faring country in June was Saudi Arabia, whilst the worse was Gabon.

To comply with the June-added clause, each country needed to achieve 100% compliance on average for May-June or retroactively cut the necessary volume between July and September, otherwise there could be yet unknown repercussions. Among the OPEC-10 countries party to the agreement, only Equatorial Guinea, Algeria and Saudi Arabia managed to achieve 100% compliance for both months.

Over 1 mb/d will have to be cut by the remaining 7 OPEC countries from July through September. The countries can elect to spread the additional cuts over three months or over a shorter amount of time as long as the 100% mark is achieved by end of September.

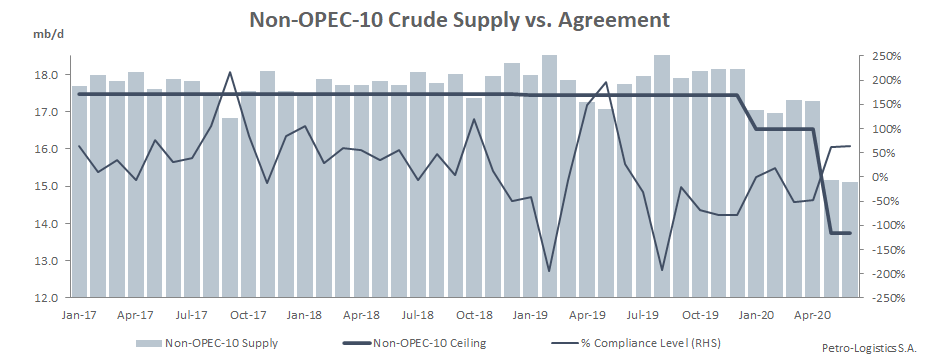

The 10 non-OPEC partners also aimed to comply with the April OPEC+ agreement but only reached a compliance level of 63% in June and 62% for the May-June period. In June, the best faring countries were Sudan and South Sudan, whilst the worst was Mexico.

Among the 10 non-OPEC partners, none reached 100% compliance over the May-June period, although Russia and Azerbaijan came the closest at 83% and 85% respectively. As a group, they will have to cut a further 920 kb/d during the period July-September.

Whilst Mexico has already announced that it will not cut beyond what was agreed in April, Kazakhstan has sent to the Organisation plans for further cuts and Oman has notified its customers of an increased 10% cut in September term allocations.

Having itself achieved a perfect 100% compliance rate, Saudi Arabia is pointing the finger at Angola and Nigeria but also Iraq and Kazakhstan over their poor compliance rate. Whilst the nature of the punishment by the Organisation itself if one does not achieve 100% compliance rate has not been fully articulated, Saudi Arabia seems determined to follow through on the threat of a price and market share war for those parties that fail to fully comply to the requisite cuts by end September.