China Continues to See Record Import Levels in June

Read in 4 minutes

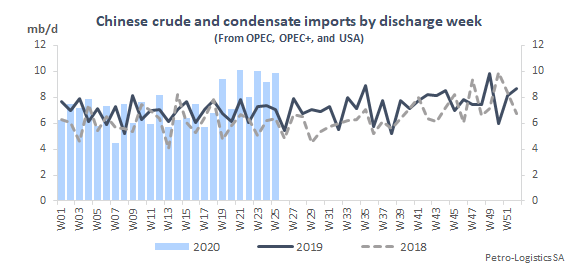

According to Petro-Logistics’ tracking, Chinese oil imports are stronger than ever, with weekly levels about 2 mb/d above the same weeks last year. Imports from all regions but particularly from the Middle East are pushing arrivals up. The average for the first 21 days of June are around 9.7 mb/d for OPEC+ and US imports.

However, imports are slowly coming off their peak levels and should be lower in July, with less intake from the Middle East and the FSU, partially offset by record US arrivals.

The largest volume went to the Shandong province, where independent teapot refiners have been running at high levels. Qingdao and Rizhao took an average of 1.15 mb/d for the first 21 days of June. Around Shanghai, Ningbo saw 858 kb/d land during the first 21 days of June.

There is also a significant volume of stored barrels off the Chinese shores. At an estimated 35 mbbls on 17 June, Chinese coasts have currently the largest amount of floating storage around the world. The barrels are mostly from the Middle East, but also from West Africa and the FSU. The majority has been anchored since the last decade of May. Most cargoes are off Rizhao and Qingdao.

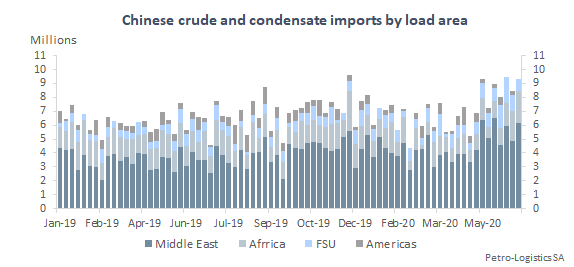

All regions’ imports remain high but imports from the Middle East and FSU are slowly coming off their record volumes whilst staying above last year’s averages. Volumes of African barrels are in a more normal range whilst American volumes are fairly low for the time being because of limited Venezuelan intake.

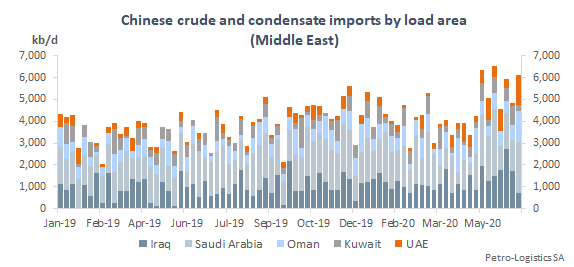

Middle Eastern imports remain strong at around 5.6 mb/d for the first 21 days of June, on par with May volumes. However, after averaging 2 mb/d in May, Saudi intake is seen down by 180 kb/d, whilst Iraqi arrivals rose to 1.7 mb/d for the first 21 days of June.

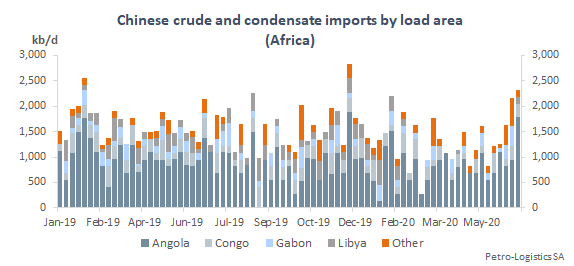

West African imports are strong so far in June, at 2 mb/d, up by 0.8 mb/d versus May. They reached the second highest levels on record, at around 2.3 mb/d for the week ending 21 June, driven by high Angolan imports but also volumes from Nigeria and Congo.

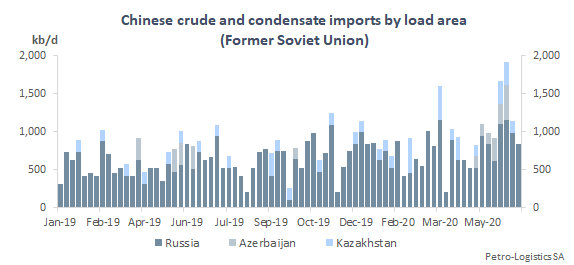

FSU seaborne exports to China are at their highest, at 1.296 mb/d for the first 21 days of June, which is 200 kb/d more than in May. Standing at 992 kb/d for June (+189 kb/d m/m), barrels out of Russia are mostly ESPO from Kozmino, at around 650 kb/d for both months, but also Urals from the Black Sea (278 kb/d so far in June) and from the Baltic (244 kb/d), whilst Azeri Light imports are at 151 kb/d and CPC at 153 kb/d for the first 21 days of June.

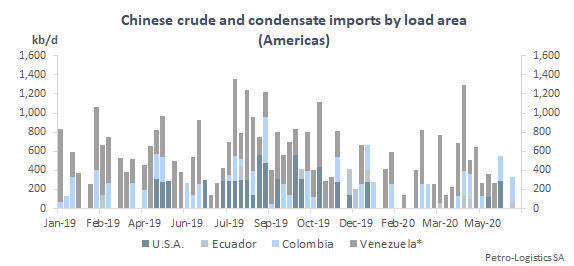

At 109 kb/d, imports from the Americas are down month-on-month for the first 21 days of June. Increased Colombian and Ecuadorian imports to 87 kb/d and 21 kb/d respectively were offset by a drop to 0 kb/d for barrels coming from the United States (- 83 kb/d m/m) and Venezuela (-259 kb/d m/m).

Looking forward, Chinese import volumes are expected to temper for the rest of June and for July as arrivals from the Middle East will be significantly lower, except for Kuwait. Out of the FSU, Kozmino intake by Chinese refiners will remain stable but July arrivals from the Black Sea and the Baltic should be half that of June and August will be even more limited, with zero loadings heading to China from the Black Sea during the first 22 days of June.

US imports into China will peak in July, with May loadings out of the USGC at around 818 kb/d. August arrivals could be the second highest level on record but down by half versus July.

Until floating storage clears Chinese shores and Chinese refinery runs further pick up, imports will be lower than the recent high levels, when refiners took advantage of low oil prices to fill their crude tanks and hold additional barrels offshore.