A Strong Start to 2024 for Chinese Crude Imports

Read in 3 minutes

[To read this post with more numbers and detail, clients can click here for the full note and potential clients may contact us here for a free two-month trial with no obligations.]

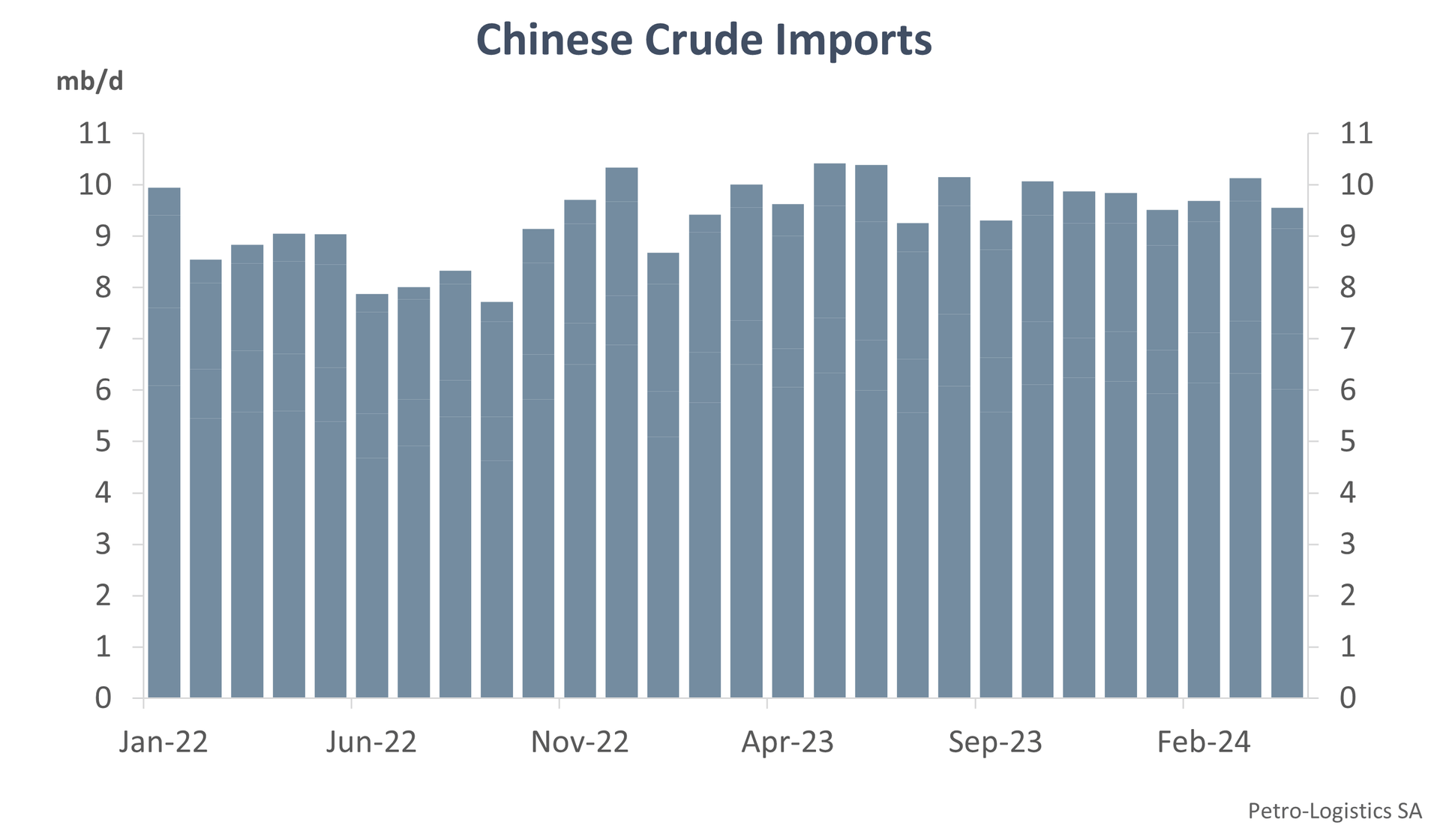

The strong performance of Chinese crude oil imports at the beginning of 2024, marked by the highest-ever first quarter, persisted into late May.

When looking at Chinese crude imports, Petro-Logistics considers arrivals into China from countries within our coverage, which includes OPEC+, West Africa, US Gulf Coast and former OPEC members (Angola, Ecuador and Qatar). For Russia, we include all cargoes going to China, including those via ship-to-ship transfers, as well as Russian & Kazakh pipeline volumes. For Iran, we include all cargoes that sail east. Versus official import statistics, Petro-Logistics is only missing about 10-12% of the country’s total crude imports.

Average crude imports for the first four months of 2024 were slightly lower than in 2023, at 9.7 mb/d (-33 kb/d vs full-year 2023). However, this follows a very strong first quarter and final May numbers are anticipated to see a recovery in imports.

It is hard to identify clear seasonality for crude imports due to Covid and economic woes that recently affected China. However, looking at the latest years, Q1'24 was the strongest first quarter ever. March imports were particularly high, at 10.1 mb/d.

Import levels in the second quarter have fluctuated widely over the years. Last year’s Q2 reached a record level of crude imports. This year, however, whilst April faltered compared to the first quarter, May imports are looking hefty.

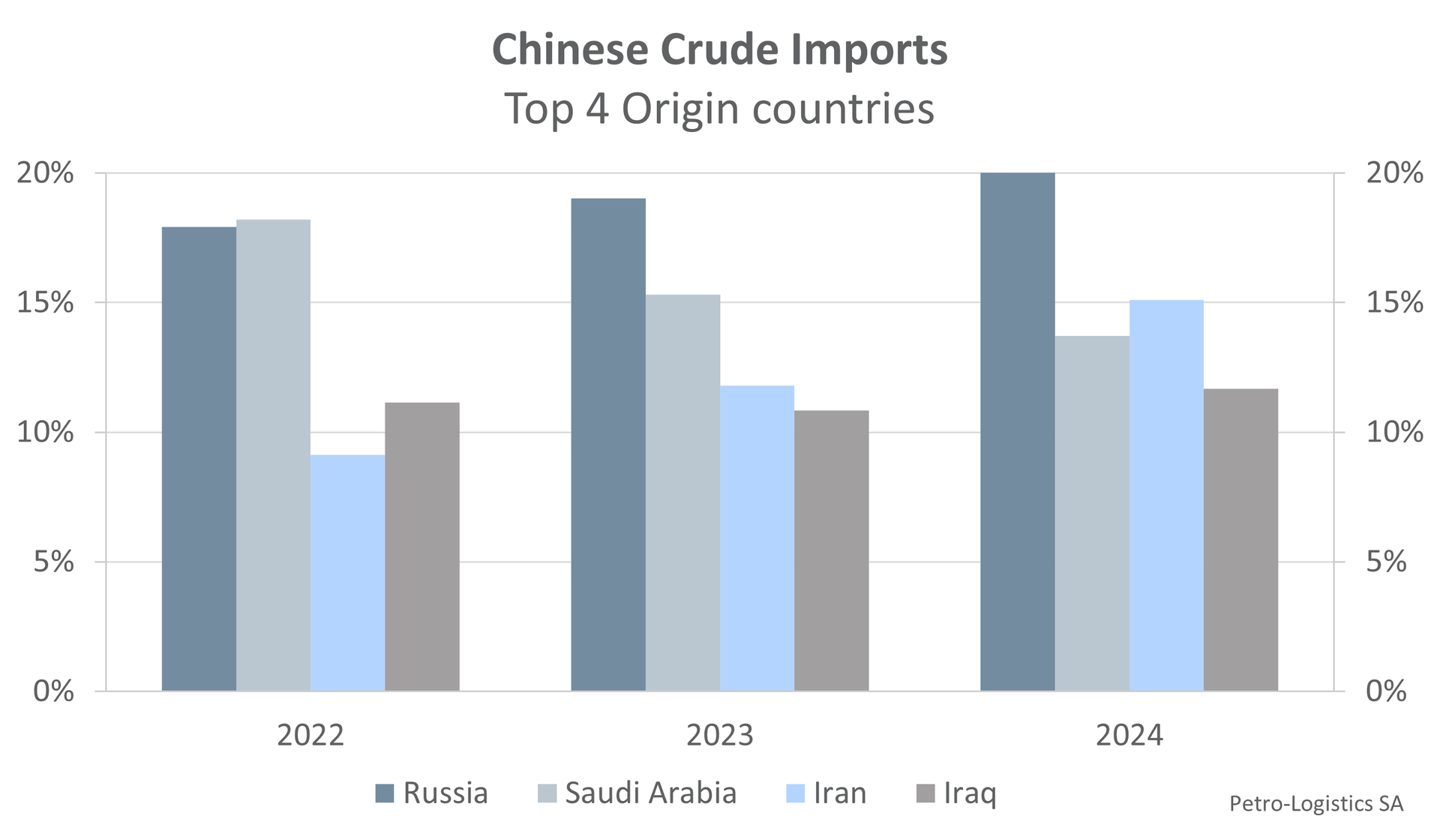

In terms of countries, Russia remains the number one supplier, with a continuing rise in its share of the Chinese market. So far in 2024, Russia is providing 20% of Chinese imports. Volumetrically, they are providing 45% more than in 2021 prior to the Russia-Ukraine conflict.

With a significant 28% y/y increase, the second largest source of crude imports is Iran, which represents 15% of China’s imports for the first 4 months of the year.

Falling from the top spot it used to hold until end-2022 is Saudi Arabia, landing as the third largest provider of crude to China. At 1.3 mb/d, the Kingdom’s share and volume of crude arriving in China keeps dropping, representing 14% of total arrivals.

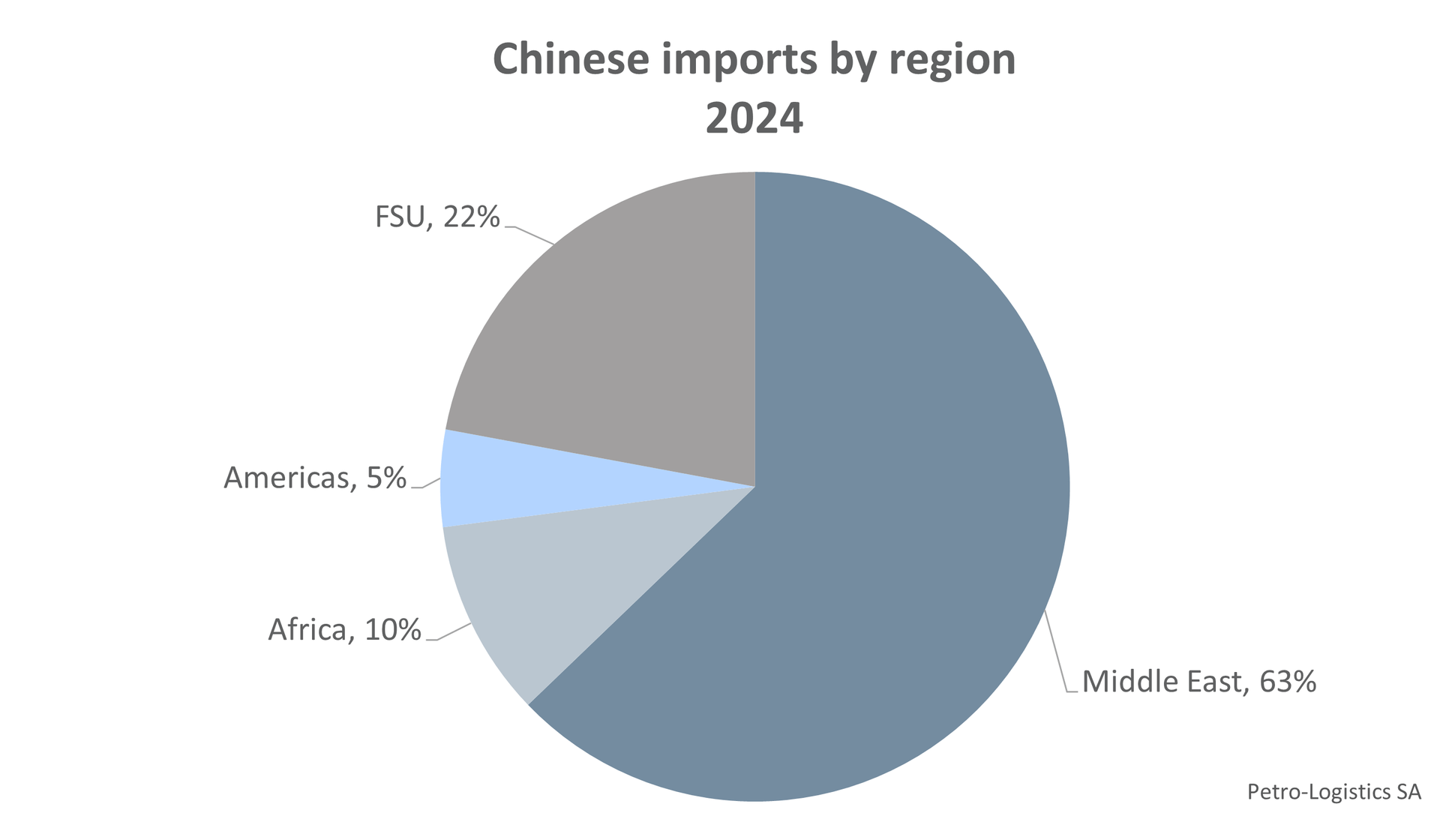

Arrivals into China from the Americas are down, only representing 5% of total Chinese imports. The US share is down, at only 3% of total imports so far this year.

Canada’s share could increase this year, thanks to the start of the expanded Trans-Mountain pipeline. The first loading was announced for China, which would bring more heavy barrels and increased competition with Iran and Saudi Arabia.

While imports from West Africa for Jan-Apr’24 have risen by 27 kb/d vs the whole of 2023, they continue to be low compared to the structurally higher years before 2022. For Jan-Apr’24 they represent 10% of total Chinese arrivals.

Competition is rife between suppliers, with a shuffling of the deck in progress: Saudi Arabia has fallen behind Russia and more recently Iran, with Iraq coming next. The Canadian Trans-Mountain pipeline will add to the complex mix to the benefit of Chinese refiners.