Russia Loading Activity Update (12 Jan 2023)

Read in 3 minutes

The below report has been released as a blog after being distributed to subscribers on 12 January 2023. Please contact our Sales Team (sales@petro-logistics.com) to receive this report each week. Petro-Logistics is the market’s leading data provider on Russian oil flows. Big changes are occurring as a result of the EU Import Ban on Russian crude & products. Petro-Logistics puts its clients in a position of knowledge and awareness as these changes occur.

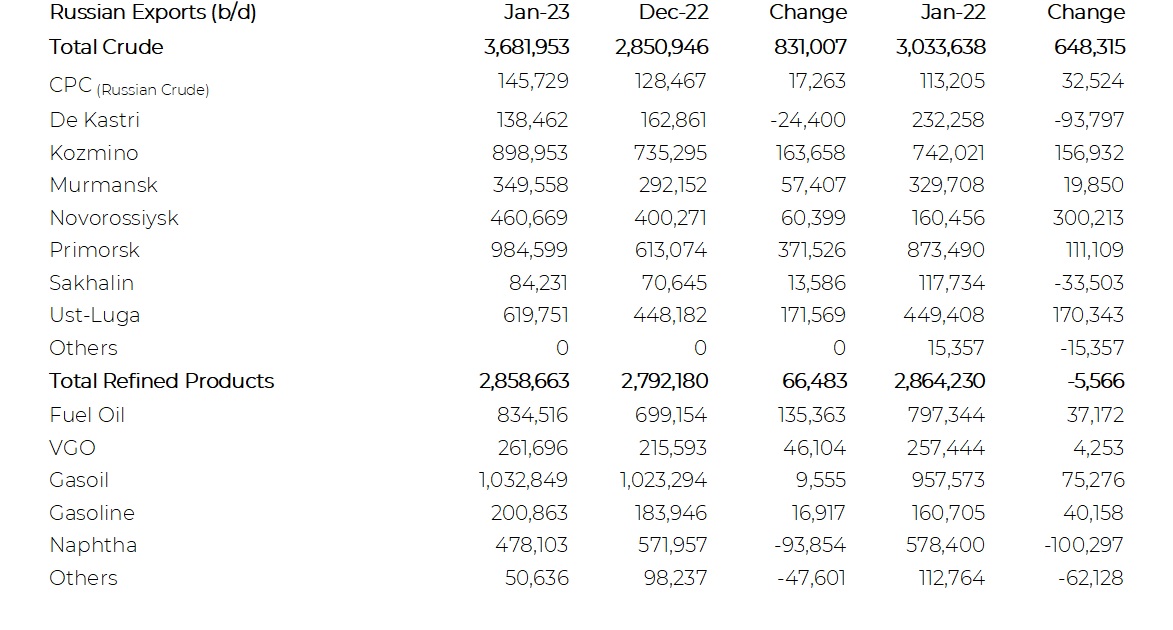

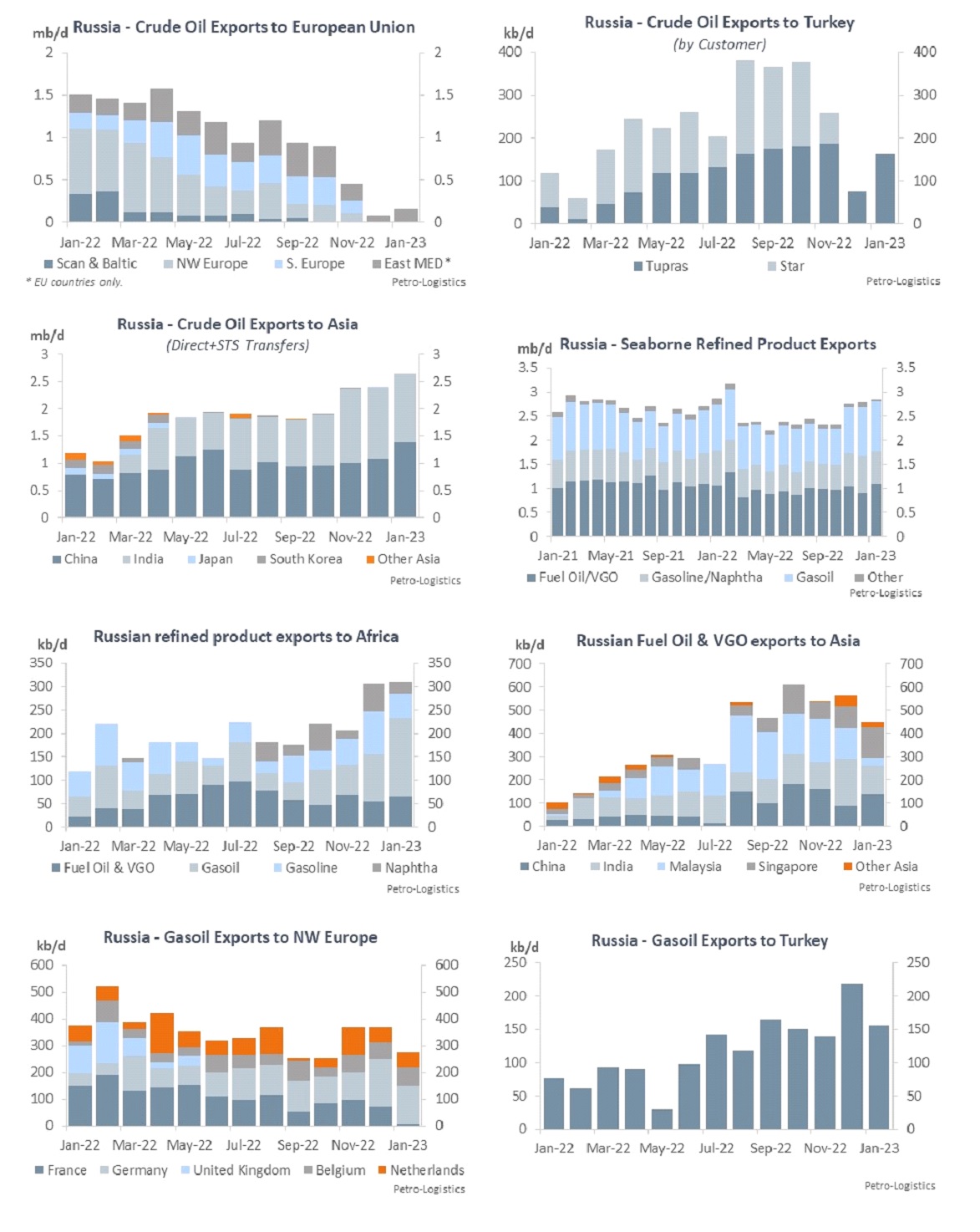

During the first 12 days of January, Russian seaborne crude exports have surged to 3.520 mb/d, 25% above December which had the year’s lowest exports. This increase was somewhat expected following the reduction of pipeline flows to Germany and Poland. However, port closures and loading delays caused slippage into January, accentuating the m/m increase.

ESPO exports from Kozmino are above 900 kb/d, up 179 kb/d m/m and in-line with the loading schedule which includes 4 cargoes from Dec and shows yet another halt in loadings (~18–22 Jan) due to assumed maintenance on the Transneft pipeline, the fourth time in 6 weeks. Crude exports from the Baltic and Arctic ports are also well up m/m following last month’s lows. Meanwhile, bad weather in the Black Sea is causing arrival and departure delays at the port of Novorossiysk, also home to the CPC terminal where Lukoil’s presence increases, up to 232 kb/d this month.

Destinations of seaborne crude flows have all but normalized as India and China absorb more. VLCCs picking up Russian barrels via STS have reemerged close to Gibraltar – 1 left fully loaded for Asia via the Cape, a partially loaded vessel is enroute to India via Suez, and a 3rd VLCC sits anchored, awaiting cargoes. STS activity off Kalamata, Greece is also up for crude – 4 cargoes, all sailing to India thus far in January.

Turkey is importing less Russian crude following Socar’s decision to stop processing Russian barrels last month. In August, the Star refinery took 218 kb/d of Russian crude, all from the Baltic Sea. Tupras is still taking Russian barrels, although down roughly 50% since the November highs.

Refined products exports thus far in January are down 126 kb/d compared to December primarily due to lower Gasoil exports from Primorsk after a slightly slow start to the month. Fuel Oil exports from the Black Sea are finally increasing, and most journeys are now direct, rather than via STS. The EU is taking what they can but increases elsewhere are starting to show such as Naphtha to Singapore, Gasoline to UAE, Gasoil to Turkey, Malaysia, South Korea, North & West Africa.